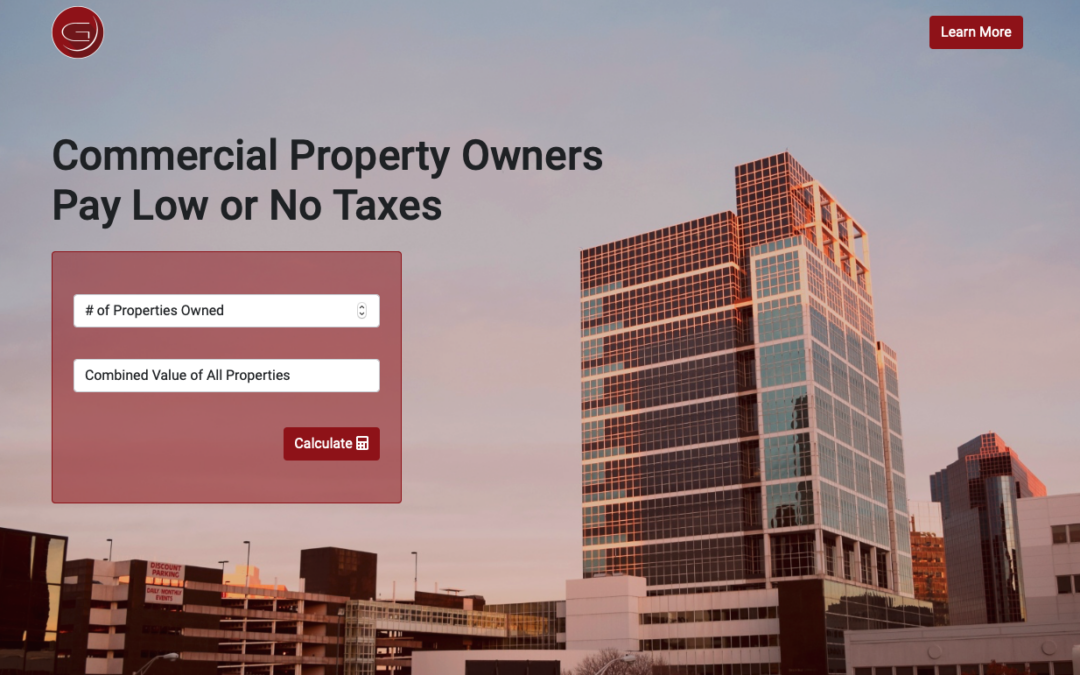

Would you like a property tax refund?

Ascend Financial Group works with businesses to recover overpaid property taxes on commercial properties. The larger the property, the more like miscalculations have occurred by the county. More than half — 60% — of property owners are overpaying these taxes, and counties will seldom ever proactively audit these on your behalf.

On a contingency basis, our firm works with Growth Management Group to mitigate property tax overpayments for you. Our team will audit the payments, attend hearings, and work with the county to mitigate payments and recover a refund for your company dating back years. Nobody wants to over pay taxes to the government, and property tax overpayments are some of the most overlooked by business owners.

In addition to property taxes are real property taxes, such as improvements and other assets purchased by the business for operations. Ascend Financial Group will set up a cost segregation strategy to put additional funds into your pocket. Cost segregation is a unique tax strategy that is often leveraged by multi-billion corporations and has been known to be less cost-effective for smaller companies. Our auditing system streamlines this process so any company with at least a $500,000 property and/or $250,000 in cost or lease hold improvements can easily leverage these tax savings.