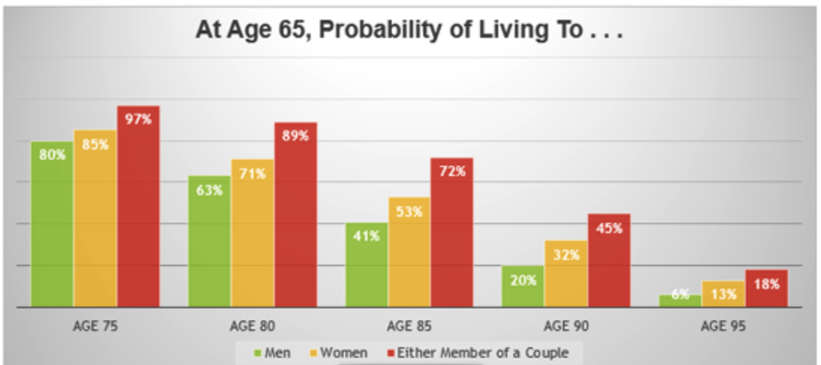

We are living longer lives and how awesome that is. But it also poses challenges to retirement planning. According to Vanguard, if you are 65 today, then you have a 97% chance of either you or your spouse living to age 75, a 72% likelihood of living to 85, and 45% opportunity of making it to 90! We just continue to live longer thanks to modern medicine, better health awareness, and a continuing improvement in living standards.

But now the money has to last longer

The only challenge we face with living longer is how to make the retirement funds last longer. The IRS has increased the age in which we can draw Social Security and now taxes the funds. It was first assumed that most would never live long enough to draw Social Security. Life expectancy at birth in 1930 was only 58 for men and 62 for women, and the retirement age was 65.

The government assumed most citizens would not live long enough to draw Social Security!

Due to living so much longer, retirement planning has to reflect strategies that will enable the money to stretch and Social Security is dangerously close to being insolvent. That means we have to save more earlier in life, build it faster and over a longer period of time, then begin to place the principal of funds into guaranteed sources of income to assure our retirements are not suddenly wiped out due to a sudden market crash, such as the COVID-19 30% decline during March.

The Required Minimum Distribution problem

Required Minimum Distributions (RMD) also pay a critical role, since this IRS law requires us to begin drawing down Qualified Plans by 70.5 (or 72 if born after 1949), or risk severe penalties. The government wants the taxes on the money. But some people may not need all the required minimum distribution at 70.5. Being forced to draw down the money when it’s not needed reduces your ability to continue sustained growth on those funds… which can place you at risk of running out money later in life.

There are several strategies, and probably the best I’ve seen is to consider a Qualified Longevity Annuity Contract (QLAC), which is an IRS rule that enables you to move a portion of your qualified funds out of an IRA or 401(k) without penalty and avoid the RMD law. Contact Ascend Financial Group to discuss setting up a QLAC and other strategies for protecting your retirement accounts to assure the funds will last.